Sarcomatrix Therapeutics

Invest Now

Raised

$2,000

Days Left

Closed

Business Description

Reasons to Invest:

- 1. Sarcomatrix is working to unveil novel therapeutics that we believe will disrupt the $2B Duchenne Muscular Dystrophy market, where current treatments merely delay progression.

- 2. With a projected $18B global market by 2030 and Duchenne Muscular Dystrophy representing a quarter of all muscular dystrophies, we believe our approach holds disruptive medical potential.

- 3. We’ve secured $8M in NIH grants in combination with our research partner, Strykagen. Your investment helps to fuel our mission-driven approach to reshape treatment paradigms in the biotech sector.

Innovative Therapeutics for Longer and Stronger Lives:

At Sarcomatrix, our innovative approach aims to target the root causes of neuromuscular disorders, such as Muscular Dystrophy, Sarcopenia, and Cachexia, rather than merely addressing symptoms–offering a promising pathway towards a better quality of life. We believe this bold strategy positions us uniquely in the biotech landscape. With NIH grants, a visionary CEO, and an anticipated backing from Battle Born Venture, we aim to redefine standards of care and are gearing up for first-in-human clinical trials and an IND filing. Our mission is deeply rooted in scientific advancements, leveraging breakthroughs in muscle regeneration to offer hope to those affected by these debilitating conditions.

Problem

At Sarcomatrix, we’re dedicated to addressing the pressing issue of muscle wasting diseases, starting with muscular dystrophies and expanding to include conditions like cachexia and sarcopenia. Our method is comprehensive: not only do we address muscle weakness, but we also provide crucial support to the diaphragm and heart, enhancing overall quality of life and extending longevity for the 14 million individuals facing neuromuscular disorders daily.

At Sarcomatrix, we’re dedicated to addressing the pressing issue of muscle wasting diseases, starting with muscular dystrophies and expanding to include conditions like cachexia and sarcopenia. Our method is comprehensive: not only do we address muscle weakness, but we also provide crucial support to the diaphragm and heart, enhancing overall quality of life and extending longevity for the 14 million individuals facing neuromuscular disorders daily.

Solution

Effective Treatments Powered by Science

At Sarcomatrix, our innovative approach aims to target the root causes of neuromuscular disorders, such as Muscular Dystrophy, Sarcopenia, and Cachexia, rather than merely addressing symptoms–offering a promising pathway towards a better quality of life. We believe this bold strategy positions us uniquely in the biotech landscape. With NIH grants, a visionary CEO, and an anticipated backing from Battle Born Venture, we aim to redefine standards of care and are gearing up for first-in-human clinical trials and an IND filing. Our mission is deeply rooted in scientific advancements, leveraging breakthroughs in muscle regeneration to offer hope to those affected by these debilitating conditions.

Business Model

TB Sarcomatrix pursues a partnership-based business model outsourcing clinical trials and manufacturing to renowned partners in the field, resulting in low overhead costs. We will use the funds to develop Laminin-111 in LAMA2-RD up to POC and out-license the project to a strong partner (in return for upfront, development & sales milestones, and royalties on sales), raise venture capital in a Series A round, or seek an M&A transaction or sale of the company.

Considering the muscular dystrophy market (US 100,000 patients) is concentrated and accessible (450 physicians at 90 clinics) with significant unmet needs, advancing our small molecule drugs to market as a focused, small specialty pharmaceutical company is reasonable, especially considering that CEO David Craig repeated this approach successfully twice; at Amgen and Gilead. Expansion to larger indications like cachexia (US $2B+) and sarcopenia (US 3B+) provides excellent upside and label expansion. These indications will be outsourced or co-developed/promoted with established pharmaceutical companies in the US and throughout the ROW.

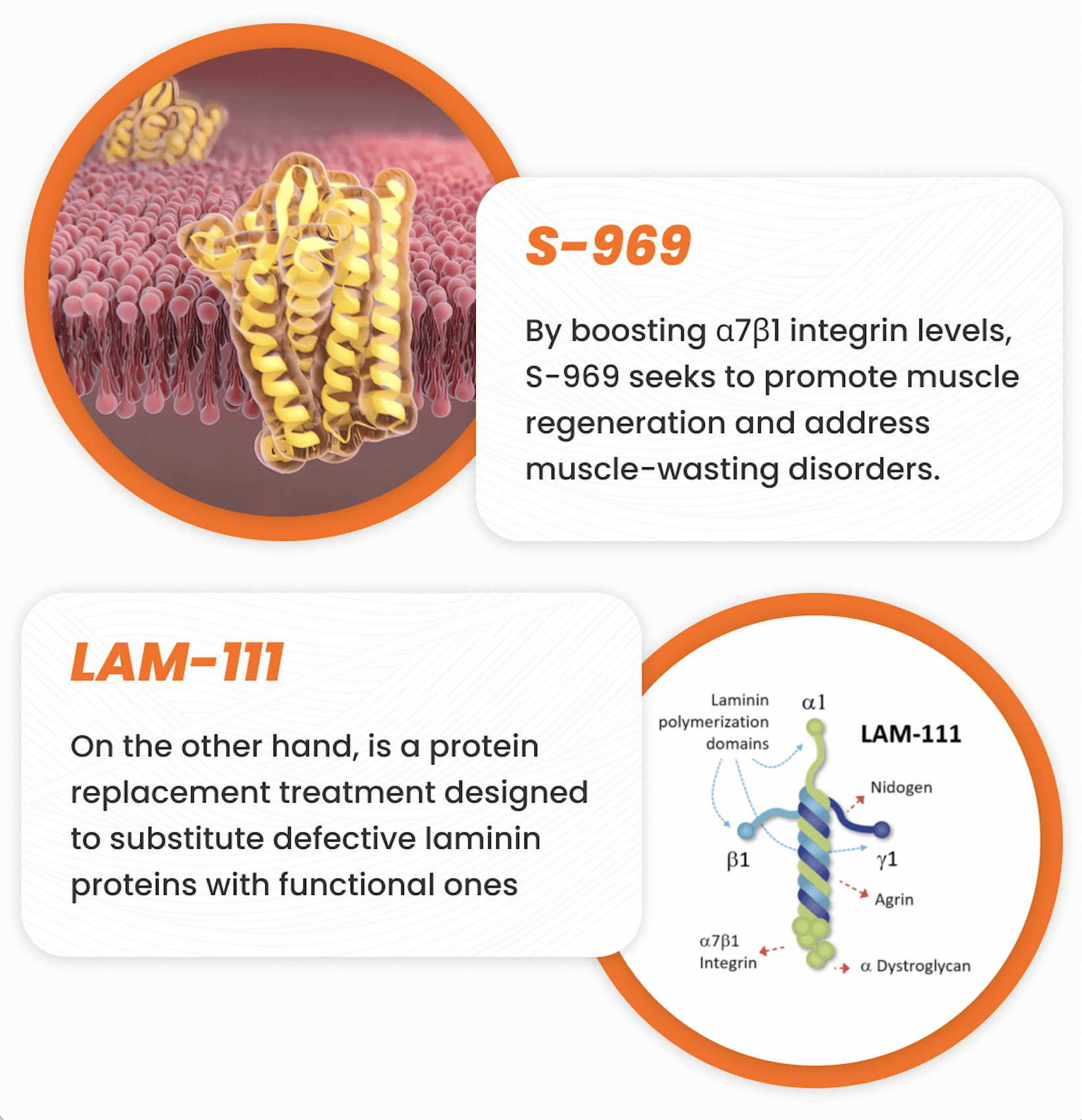

The IP supporting the small molecules and proteins is robust, covering the US, EU and key regions. Our first to market small molecule S-969 is protected in the US through 2033, and our second-generation compounds allowing for a market switch strategy extend beyond 2045. The laminin-111 patent extends through 2036 and already has orphan drug status throughout the EU. Large molecule protein patents, often related to biologics, are easier to extend for a variety of reasons compared to small molecule drugs and developing a biosimilar (analogous to a generic version for small molecule drugs) is significantly more challenging for biologics due to their complexity. Additionally, the Inflation Reduction Act (IRA) of 2022 offers up to 13 years of price control relief, vs. 9 years for small molecules.

Market Projection

Large Market Potential!

Sarcomatrix is advancing two anticipated flagship drugs, S-969 and LAM111, with the backing of $8 million in NIH grants. The Duchenne Muscular Dystrophy market, currently valued at $2 billion, presents immense growth potential, projected to soar to $18 billion worldwide by 2030. With exclusive worldwide product licensing, active Orphan Drug applications, and anticipated strategic funding initiatives like the Battle Born Venture Fund soft circled, we believe we’re positioned for substantial traction and market impact.

Competition

Sarcomatrix Therapeutics faces competition in the muscular dystrophy treatment market from established players such as Sarepta Therapeutics, known for its gene therapy and RNA-based treatments, and Solid Biosciences, which focuses on gene therapy for Duchenne Muscular Dystrophy. However, we believe Sarcomatrix sets itself apart with its groundbreaking α7β1 integrin activators and protein replacement therapies, targeting both muscular dystrophy and a wider range of neuromuscular disorders. This dual-focus approach, aimed at not just symptom management but also at disease reversal and muscle regeneration, alongside its robust portfolio of intellectual property and strategic collaborations for clinical development, distinctly positions Sarcomatrix.

Traction & Customers

Fueling Hope and Empowering Progress

We’re in the process of securing a license for a patent portfolio consisting of over 75 patents, which could help us protect drugs like S-969 and LAM111. With a solid foundation of IP in the works, a powerhouse team of geneticists, chemists, and innovators with 130+ years of experience and a track record of delivering over 20 medicines to the public, Sarcomatrix is on track to revolutionize treatment strategies for muscle disorders.

Investors

Why Invest?

Invest in Sarcomatrix, where our anticipated pioneering biotech has the potential to meet compassionate innovation. With a mission to improve lives affected by muscle diseases, we feel that Sarcomatrix is on the brink of groundbreaking clinical trials, offering investors a chance to become vital allies in the battle against muscular disorders, and part of our transformative journey. The potential to reshape the Duchenne Muscular Dystrophy community is truly profound.

Join us as we embark on our first non-human primate study, a crucial step towards bringing life-changing treatments to those in need. Together, let’s make a real-world difference.

Terms

Up to $1,175,000 in Common Stock at $2.50 per share with a minimum target amount of $10,000.

Offering Minimum: $10,000 | 4,000 shares of Common Stock

Offering Maximum: $1,175,000 | 470,000 shares of Common Stock

Type of Security Offered: Common Stock

Purchase Price of Security Offered: $2.50 per Share

Minimum Investment Amount (per investor): $500.00

The Minimum Individual Purchase Amount accepted under this Regulation CF Offering is $500.00. The Company must reach its Target Offering Amount of $10,000 by January 31, 2025 (the “Offering Deadline”). Unless the Company raises at least the Target Offering Amount of $10,000 under the Regulation CF offering by the Offering Deadline, no securities will be sold in this Offering, investment commitments will be cancelled, and committed funds will be returned.

Risks

As an investor, please be sure to read and review the Offering Statement. If you have any unanswered questions, please be sure to utilize the communication channel on this page to ask the issuer questions.

A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

Equity Security

Price Per Share

$2.50

Shares For Sale

470,000

Post Money Valuation:

$14,300,000

Investment Bonuses!

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

January 31, 2025

Minimum Investment Amount:

$500

Target Offering Range:

$10,000-$1,175,000

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.

David Craig

resident, CEO and Chairman of the Board

BackgroundWith over 30 years experience developing products in the life sciences industry, David has worked in building biotechnology companies and supporting their initial fundraising efforts, growth and commercialization. He has previously held senior positions at Amgen, AstraZeneca, Gilead and Alexion. He will be providing Form C sign-off as the Company’s Principal Accounting Officer.

David Alan Maine

Chief of Staff

BackgroundI’m an economist who is valued as a decision-support partner with company founders, co-founders, and academic professors. By providing distinct analysis, data sourcing, market research, financial modeling, business acumen and critical decision-making, I am able to refine business models and value propositions into efficient operational practices to accelerate commercialization. Driven by opportunity to improve global health, I have partnered with several firms to bridge early stage development processes into real world applications.

Ryan David Wuebbles

Chief Scientific Officer

BackgroundDr. Ryan Wuebbles received his PhD in 2009 from the University of Illinois. He been involved in researching muscular dystrophy causes and therapeutics for over 20 years, including 15 years working with Dr. Burkin developing the Laminin and small molecule programs.

Dean Josef Burkin

Board Member

BackgroundDean Burkin is a Professor of Pharmacology and Interim Chair of Physiology and Cell Biology at the University of Nevada, Reno. The primary goal of my research program is to understand the role integrin receptors and the extracellular matrix play in muscle disease and develop novel therapeutics.

Michael J.M. Hitchcock

Board Member

Background“Michael J. M. Hitchcock, Ph.D. (Mick) is currently Adjunct Professor of Microbiology at University of Nevada, Reno (UNR) Medical School and a member of the Advisory Boards for the UNR Colleges of Science and Business. He is also a Trustee Emeritus of the UNR Foundation Board, and was Chair in 2020. In addition he serves on the Board of Directors for 3 small companies (Biomea Fusion, Renogenyx and ClickBio) and a pro-science information organization (American Council for Science & Health). His career in pharmaceutical research & development spanned 40 years, initially with Bristol-Myers Squibb for 12 years. He joined Gilead Sciences, Inc. in 1993 and helped it grow from only 100 employees and no products or revenues to >20,000 employees and >$20B annual revenue. Over 27 years, he was Vice President for project and portfolio management, alliance management, strategic planning, medical affairs, specific areas of research, and then Senior Advisor. During his career, he was involved in the development and commercialization of a number of anti-infective agents, primarily drugs for treatment of viral diseases. This included the first single pill containing 3 drugs (ATRIPLA) that can be taken once daily to simplify treatment of HIV; and that led to additional single tablet regimens that are the standard of care today.

Company Name

Sarcomatrix Therapeutics

Location

450 Sinclair St

Reno, Nevada 89501

Number of Employees

5

Incorporation Type

C-Corp

State of Incorporation

DE

Date Founded

May 20, 2022